“How do I manage the PPP Loan and forgiveness process for an ERP system?” is a common question we have been receiving from our clients. The below scenario is intended to add insight on how a process would flow, and how to maintain multiyear comparatives in the financial reporting. Note: We always advise our clients to reach out to their CPA or Accounting Professional for their advice. This is just an example.

Let us use a basic example to show how a company received PPP loan for $200,000, with 20 Employees.

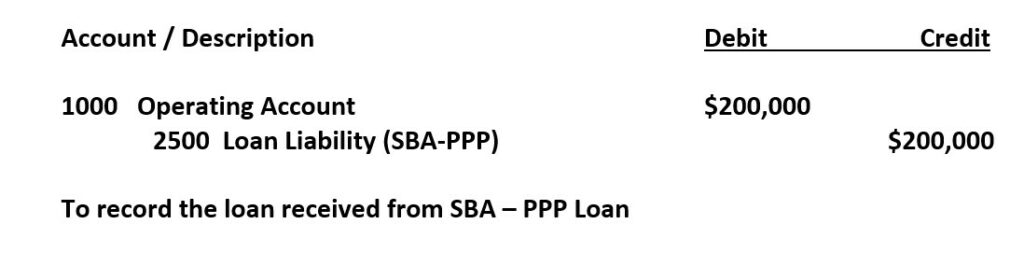

When the company received the PPP Loan, the accounting department may have seen the deposit directly into the company’s bank account. The first transactions should be to record the increase in the operating account. A typical process could have been done with a Journal Entry:

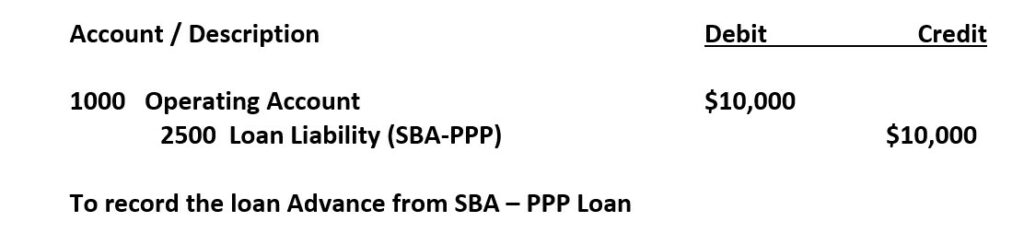

There may have also been an advance that was received, and I believe it was for $1000 per employee up to $10,000. This will also need to be recorded. As of 1/31/2021, I do not believe this was forgiven, again, please reach out to your CPA for advice, as this is just showing a way on how the accounting can be managed. In our example, they received the $10,000 advance.

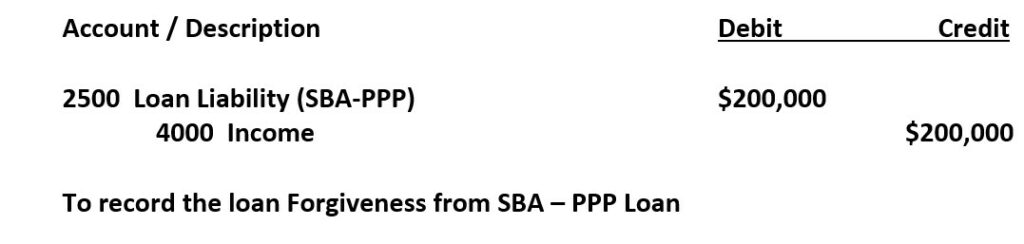

Once the PPP Loan has been forgiven, then the accounting of the Loan Liability is to be moved from the balance sheet to the Income account. The one thing that was stressed to me was GAAP (Generally Accepted Accounting Principles) wants that in the year that the forgiving took place. If you filed early and received the forgiveness in 2020, then the accounting should take place in 2020. Otherwise, you will need to record this as a 2021 transaction.

This is the part that seems to be confusing as the government said it will not be taxed. Showing the PPP Loan as income will artificially inflate the sales you had, and it will show possible inaccurate Gross Profit and Net Income in either the 2020 year or a future year. Your CPA will help with the tax part, and they will adjust your returns to eliminate the PPP Loan from the tax calculation. But, how does a company use the financial reporting or comparative reporting to help drive the company forward?

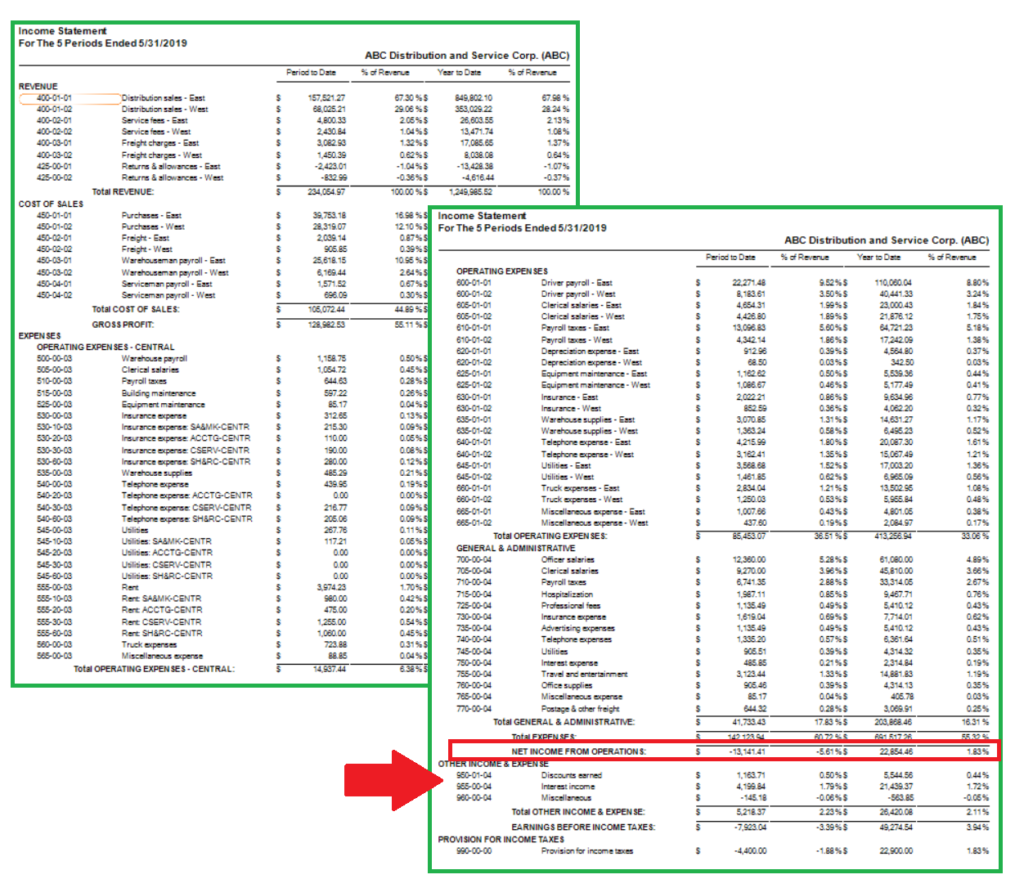

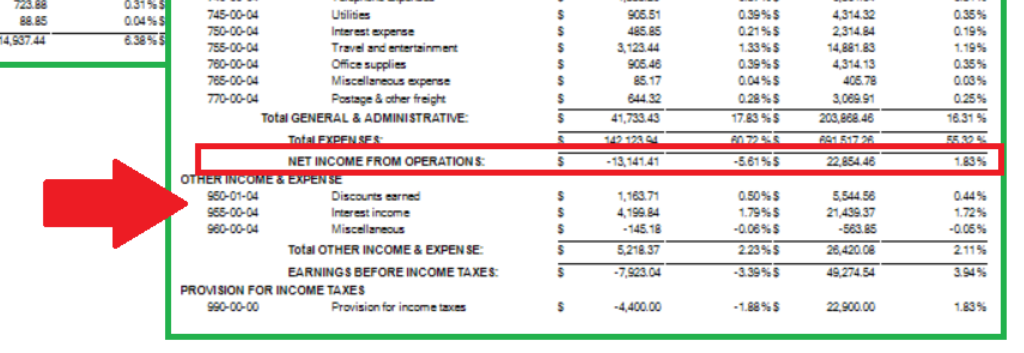

I think the 2020 and the 2021 years are going to be difficult to use the standard financials, so how can we make the process easier? I suggest that you do not add the loan forgiveness to the Revenue Section of your Profit and Loss Statement, but rather below the Business Operating Income(Net Income from Operation) to the Misc. Section just above the Net Income.

The change to the Other Income and Expense, allows us to open “Net Income from Operations” to compare past years, and still be compliant with GAAP.

For most companies, this may just be an easy export to Excel make the changes in the reports and then share with management. Others may want to make the changes in their custom report writer, so they can push a button and get the results. Our staff here is willing to review what you are doing and would be happy to help.

As for the remaining Advance loan, it may need to be paid back. This process can be done a few different ways, but what I think may be the easiest is that you create SBA (Small Business Administration) as a vendor, or if you have one, just record the Advance portion of the Loan as a payable. The expense general ledger account number should be the loan number you used originally when recording the cash. My example above was 2500 Loan Liability (SBA-PPP) . Then, use Accounts Payable to pay the loan off and record any interest that occurs.

Are there additional ways to have processed the PPP Loans? Yes, I am just offering a way that you can follow how it can be completed. However, please speak with your accounting professional on how they want you to process the PPP Loan.

Are you interested in learning more about how ACC can help you? Contact us today for help!

Solutions by Industry

What's New

Outgrowing Your ERP? Why Acumatica is the Upgrade You Need

Read MoreSubmitted by Stephanie Dean on Thu, 06/26/25 - 15:52

Why You Should Make the Switch: NetSuite to Acumatica

Read MoreSubmitted by Stephanie Dean on Tue, 06/17/25 - 13:36

Acumatica ERP for Sustainable Businesses

Read MoreSubmitted by Stephanie Dean on Thu, 05/29/25 - 10:37